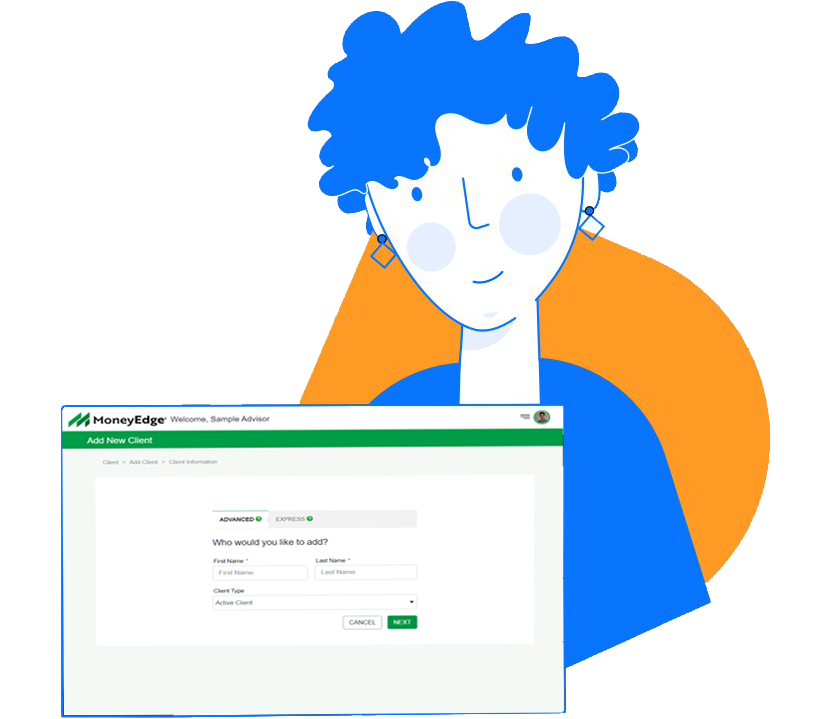

STEP 1:

Add a Client

Take Your Pick

MoneyEdge offers multiple ways to add client information:

-

Client Onboarding - Invite your client to get started on their plan by completing a simple on-line form

-

Manual Entry - Enter client details yourself behind the scenes.

-

Express Onboarding - When you need a simple plan in a hurry, try Express Onboarding.

-

Data Aggregation - Allow clients to link online accounts with Data Aggregation.

STEP 2:

Make a Plan

Start with the basics...

MoneyEdge provides the tools you need to create great financial plan:

-

Current Position - See how your client is doing financially at a glance.

-

What-if scenarios - Make simple adjustment to see how they would affect the plan.

-

Income Projection - See how much your client expects to earn.

-

Retirement - Compare retirement goals with your client's current situation.

-

Emergency Fund - Figure out if your client has enough saved up to handle an emergency.

-

Education - Evaluate progress toward college savings goals.

...and keep going!

MoneyEdge goes beyond the basics to give you and your client additional tools, including:

-

Debt Elimination - Rather than assume your clients are ready to invest, MoneyEdge gives you a way to help them get out of debt.

-

The DIME Formula - Shows your client how much life insurance may be needed.

-

Income vs. Expenses - Analyze the how your clients make and spend money.

-

Simple Calculators - Focus on just one piece of your clients finances.

-

Action Plans - Assign next steps to your client or yourself.

-

Concise Reports - Pull the plan together into report form for your client.

STEP 3:

Share the Plan

Share the Plan Your Way

With MoneyEdge, you can give your clients a financial plan in a format that makes sense to both you and them:

-

Client Access - Give clients access to MoneyEdge for ongoing access to their financial plan.

-

Prepare Reports - Choose some or all sections to include in a prepared report.

-

Print Reports - MoneyEdge reports are concise enough to print for clients who want paper, but you can also save them to PDF.

-

Secure Vault - Drop the saved reports or full plan into the secure vault.